Institutional Overview

On the one hand, investors must make the best portfolio, inevitably compare and analyze various securities; on the other hand, if the securities can be approved Listed, the continued issuance of listed securities is attractive to investors, etc., all have thousands of contacts with the grade assessment of securities.

Interim Measures for Securities Corporation Bond Management stipulates that securities credit rating agencies are responsible for the objective, fairness and timely time of rating results. Therefore, credit rating agencies must be recognized by the market, to obtain credibility, must strictly follow independent, objective, and fair principles.

Securities rating

The rating of the securities consists of two parts: rating and rating of stocks.

Bond rating

In addition to the highly reputable national debt, the company's bond issuer, foreign government bond issuer, etc. voluntarily to assess the application level of rating agencies specializing in the security rating business. . The rating company mainly considers four principles in the rating process:

1) Securities issuance company's solvency.

2) Communications distribution company's credit.

3) The risk of investors bear.

4) Legal nature of the company's debt.

The method of bond rating is substantially the same as the bond level.

Stock rating

Strictly speaking, the stock rating is a series of shares, which is divided into different levels of dividends and shareholders in various stocks, stock profits and risks. The prospect of the stock of stocks, classify the stock, as a shareholder to adjust the reference information and basis of the business decision, so it is different from the bond rating.

Securities rating agency's evaluation of the applicant is only negatively obligated, and there is no legal responsibility, and they have high rating of some bond rating, not to investors recommend these bonds, just Evaluate the issue of the issuance of the bond, the credentials, the risk of investors, and the rating of the stock does not have a "qualitative" role, and the investors should be selected by investors.

Effect

1, the underwriter can decide the distribution price, release method, underwriting cost, and how promotional means according to the high and low of the securities level.

2, self-operators can assess the size of their business risks according to the credit rating of various securities, so that their own risk management is also conducive to internal management departments. The supervision of its business will prevent itself due to excessive risk.

3, brokers give different securities and distribution rates for different securities levels during the credit transaction.

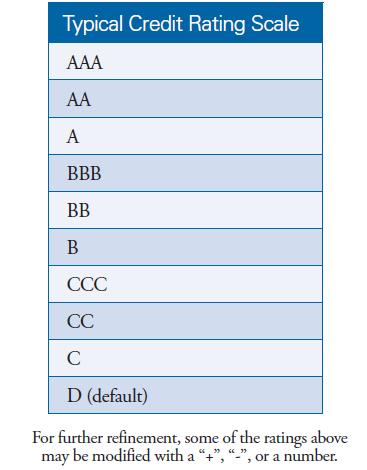

The assessment of securities quality is very important to the issuer, investor and securities. The more famous securities rating agencies in the United States have: US Moody Investment Service Company, Standard - Poor; Japan's Bond Rating Institute; British International Banking and Credit Analysis Company, etc. The securities grade of these companies have objectively reflect the level of creditors and securities itself. They are generally completely independent, not subject to government and any institutions, but with securities management agencies have very close contact, the business activities of rating agencies have formed a supervision of the participants in the securities market. Many countries concerned have different restrictions on different levels of securities issuers in the securities market. It can obtain the highest level of issuers generally can issue securities, raise funds, and their securities are also in the market. Popular.