Company system introduction

According to Professor Fangfang, the company has been called "croissants", which is the exclusive title for the UK East India. In the history of more than a hundred years, Chinese "company" is gradually clear in the constant misleading and reinterpretation.

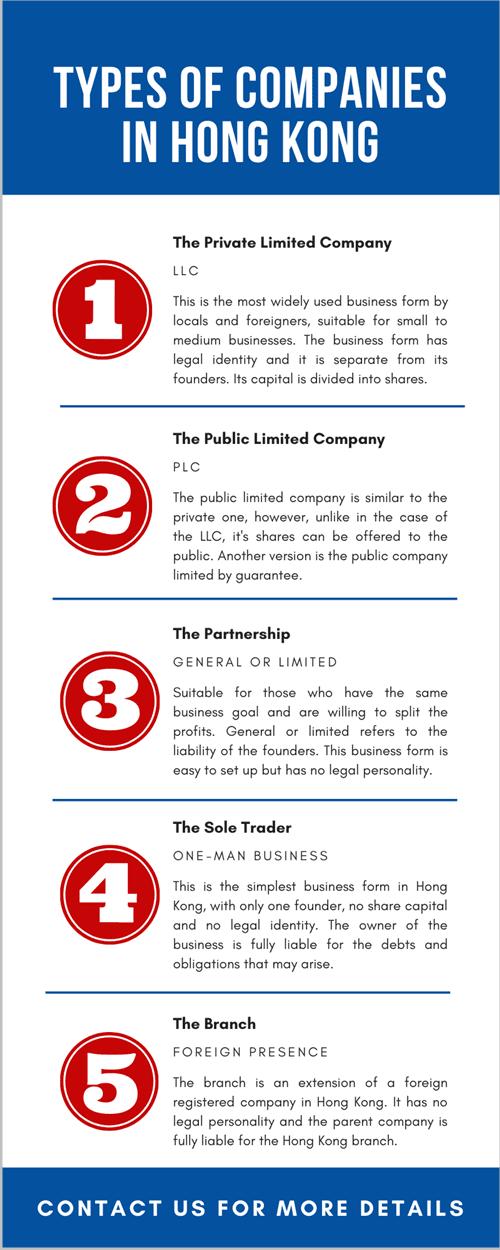

The difference between "individual-owned enterprises, partnership, company enterprises", partners, corporate companies Personal-owned enterprise

refers to " Solar-owned Enterprise Law is established in China. It is owned by a natural person investment, property is owned by investors, and investors have an unlimited responsibility of corporate debt in their personal property.

Partnership Enterprise

refers to the partnership agreements established in China in accordance with the Partnership Act, jointly funds, partnership, sharing benefits, coexisting risks. And the partnership debt is responsible for the unlimited joints.

Partnership companies refer to natural people, legal and other organizations in accordance with the general partnerships and limited partnerships established in China in accordance with this Law.

Ordinary partnership consists of ordinary partners, and the partners bear the unlimited joint responsibility for the partnership debt. This Law has specially stipulated in the form of the general partner's responsibility.

limited partnership consists of ordinary partners and limited partners, and ordinary partners assume unlimited joint responsibility for partnership debt, limited partners take responsibility for their payment .

Company Enterprise Enterprises

refers to an organization that is generally based on the purpose of making profits, engaged in commercial business activities or some purposes. According to the current China Company Law (2005), its main form is a limited liability company and the company. Both of the two types of companies are legal persons (36 civil law), and investors can be protected by limited liability.

The company generally refers to a class of profit legal governments registered in the legal registration authority.

Advantages and Disadvantages

Company Enterprise Advantages

1. Unlimited Volume

a company in the initial Once the owner and the operator still exit after exiting.

2. Limited debt responsibility

Company debt is the legal debt, not owner's debt. The owner's debt responsibility is limited to its capital.

3. The liquidity of ownership is strong

4. The superior status of the capital market

company The shortcomings of enterprises

1. Double taxation

As an independent legal person, its profit needs to pay corporate income tax, and the company's profits are allocated to shareholders. Shareholders also need to pay personal income tax.

2. The cost of forming the company is high

Company law for establishing a company's requirements, which is a sole proprietorship or partnership, and needs to be submitted.

3. There is a proxy problem

After the operator and the owner are separated, the operator is called an agent, the owner is called a principal, agent It is possible to hurt the principal's interests for your own interests.