Users

Creditors

Fromthestandpointofcreditors,theyaremostconcernedaboutthesafetyofvariousfinancingmethodsandwhethertheycanrecovertheprincipalandinterestonschedule..Ifthecapitalprovidedbyshareholdersonlyaccountsforasmallproportionofthetotalassetsoftheenterprise,therisksoftheenterprisearemainlybornebythecreditors,whichisdisadvantageousforthecreditors.Therefore,creditorshopethatthedebt-to-assetratioisaslowaspossible,andthatthedebtrepaymentoftheenterpriseisguaranteed,andthefundsfinancedtotheenterprisewillnotbetoorisky.

Investors

Fromtheperspectiveofinvestors,whatinvestorscareaboutiswhethertherateofreturnontotalcapitalexceedstheinterestrateofborrowedcapital,thatis,theinterestrateofborrowedcapital.Iftherateofreturnonallcapitalexceedstherateofinterest,theinvestor’sprofitwillincrease.Onthecontrary,iftherateofreturnonallcapitalislowerthantheinterestrateonborrowedfunds,theinvestor’sprofitwilldecrease,whichisnotgoodforinvestors..Becausetheexcessinterestonborrowedcapitalhastobecompensatedbytheinvestor’sshareofprofits,investorshopethatthehigherthedebt-to-assetratio,thebetteriftherateofreturnontotalcapitalishigherthantheinterestonborrowedcapital,otherwisetheoppositeistrue.

Operators

Fromtheoperator’spointofview,iftheamountofdebtislargeandexceedsthecreditor’spsychologicaltolerance,thecompanywillnotbeabletoraisefunds.Thegreatertheborrowedfunds(ofcoursenotblindborrowing),themorevigoroustheenterpriseappears.Therefore,operatorshopethattheasset-liabilityratiowillbeslightlyhigher,andthroughdebtmanagement,expandthescaleofproduction,openupthemarket,enhancethevitalityoftheenterprise,andobtainhigherprofits.

Influencingfactors

ProfitandNetcashflowAnalysis

Theincreaseinthedebt-to-assetratioofacompanyfirstdependsonwhethertheprofitrealizedbythecompanythatyearhasincreasedoverthesameperiodofthepreviousyear,andwhethertheincreaseinprofitsisgreaterthantheincreaseinthedebt-to-assetratio.Ifitisgreaterthanthat,itwillbringpositivebenefitstotheenterprise.Thispositivebenefitmakestheowner'sequityoftheenterpriselarger.Astheowner'sequityincreases,thedebt-to-assetratiowilldecreaseaccordingly.Secondly,itdependsonthecompany'snetcashinflow.Whenacompanyborrowsalotandachieveshigherprofits,therewillbemorecashinflows,whichshowsthatthecompanyhasacertainabilitytopaywithinacertainperiodoftime,canrepaydebts,andguaranteetherightsandinterestsofcreditors.Italsoshowsthatthebusinessactivitiesofthecompanyarebenign.Circular.

Assetanalysis

Analysisofcurrentassets:Thelevelofcorporatedebt-to-assetratioandtheproportionofcurrentassetsintotalassets,thestructureofcurrentassets,andthequalityofcurrentassetsarecrucialconnect.Ifthecurrentassetsaccountforalargeproportionofthecompany'stotalassets,itmeansthatthecompany'srapidcapitalturnoverandstrongliquiditycapitaloccupythedominantposition,eveniftheasset-liabilityratioishigh,itisnotterrible.Thestructureofcurrentassetsmainlyreferstotheproportionofassetssuchascorporatemonetaryfunds,accountsreceivable,andinventoriesintotalcurrentassets.Thesearetheassetswiththefastestliquidityandthestrongestabilitytopayamongthecompany'scurrentassets.Weknowthatmonetaryfundsarecashfunds,accountsreceivablearefundsthatarewithdrawnfromcirculationatanytime,andinventoriesarefundsthatarerealizedwiththerealizationofsales.Theamountoftheseassetsdirectlyaffectsthecompany'sabilitytopaycash.Iftheratioislarge,itmeansthatthestructureofthecompany'scurrentassetsisrelativelyreasonableandthereareenoughrealizableassetsasaguarantee.Onthecontrary,itmeansthatmostofthecompany’scurrentassetsareunprocessedassets,prepaidexpenses,andrelativelysolidifiedorexpense-orientedassets.Theseassetsareexpensesthathaveyettobeabsorbedbythecompany.Notonlycantheynotberealizedfordebtrepayment,buttheywillconsumeanderodethecompany.Profit,thisisalsoadangeroussignal.Thequalityofcurrentassetsmainlydependsonwhethertherearebadandbaddebtsinthecompany'saccountsreceivable,howbigitsproportionis,whetherthereareunsalablegoodsandlong-termbacklogsininventory,whetherthecompanyhasmadeprovisionforbaddebts,sellingpriceprovision,andprovisionforbaddebts1.Whetherthesellingpricereserveissufficienttomakeupforthelossofbadandbaddebts,thelossofunsalablegoodsandthelossofoverstockedmaterials.

Long-terminvestmentanalysis:Investmentisanenterprisethatincreaseswealththroughdistributionandobtainsmorebenefits.Whethertheinvestmentoftheenterpriseisreasonableandfeasible.Firstofall,itisnecessarytoanalyzewhethertheproportionofenterpriseinvestmentintotalassetsisreasonable.Iftheproportionofinvestmentistoohigh,itmeansthatthescaleofinvestmentoftheenterpriseistoolarge,andthescaleofinvestmentwilldirectlyaffecttheliquidityandpaymentabilityoftheenterprise,especiallyintheextremedebt-to-assetratio.Inthecaseofhigh,thecompanyisforcedtoberestrictedindebtrepayment,andevenaffectthecompany’sreputation.Secondly,itisnecessarytoanalyzewhethertheenterpriseinvestmentprojectisfeasible,thatis,whethertheinvestmentreturnrateishigherthanthefinancinginterestrate,iftheinvestmentreturnrateishigherthantheinterestrate,thentheinvestmentisfeasible.

Analysisoffixedassets:Thescaleoffixedassetsisveryimportantforenterprises.Thefirstistheproportionoffixedassetsinthetotalassetsoftheenterprise.Usuallytheamountoffixedassetsshouldbelessthanthenetassetsofthecompany,accountingfor2/3ofthenetassetsaswell,sothat1/3ofthenetassetsofthecompanycanbeliquidassets,andintheenditwillnotrelyonauctioningfixedassetstorepaydebt.Theproportionoffixedassetsistoohigh,indicatingthatthecompany'sliquidityabilityispoor,andthecompany'sabilitytorepaydebtsispoor.Thesecondiswhethertheproportionoffixedassetsforproductioninfixedassetsisreasonable.Iftheproportionoffixedassetsforproductionislow,itmeansthattheproportionoffixedassetsfornon-productionislarge.Sincetherearefewfixedassetsforproduction,itisverylikelythattheneedsofproductionandoperationcannotbemet,andthebusinessobjectivesoftheenterprisearedifficulttoachieve.Ifthefixedassetsfornon-productionusearetoolarge,theamountofdepreciationincludedinthecurrentprofitandlossoftheenterprisewillbelarge.Iftheamountofdepreciationistoolarge,theprofitoftheenterprisewillbelow,andthecashinflowwillbesmallwhentheprofitislow,whichweakenstheabilityoftheenterprisetorepaydebts.

Liabilityanalysis

CurrentLiabilityAnalysis

Generallyspeaking,thehighertheasset-currentratio,themoreassuredthecreditors,buttheliquidityIftheratioistoohigh,apartofthefundswillremainintheformofcurrentassets,whichwillaffecttheprofitabilityofthecompany.Therefore,companiesshoulddeterminearelativelyreasonablelimitforthecurrentratio.Belowthislimit,thedebt-to-assetratiomaybehigh,andcorporatecreditmaybedamaged,andthendebtwillbedifficult;higherthanthislimit,itmeansthatsomeofthefundsareidle.Theuseefficiencyisnothigh,resultinginawasteoffunds.

Analysisofshort-termborrowing:Thehigherthecompany’sasset-liabilityratio,themorethecompanyborrowsfromthebank.Therefore,whenacompanydecidestoborrow,itmustfirstanalyzethemarketsituationandusethemarket’seconomicenvironment,economicconditions,andeconomicsituation.Makeajudgmentonwhethertoborrowmoneytooperate.Itisfeasibletoraisedebtwhenthemarketprospectsaregood,otherwiseitisnotappropriatetoraisedebt.Secondly,itisnecessarytoanalyzewhethertheprofitleveloftheenterpriseafterborrowingishigherthantheinterestleveloftheborrowing.Iftheprofitleveloftheenterpriseishigherthantheinterestleveloftheborrowing,itmeansthattheenterpriseborrowingoperationisprofitable.Onceagain,itisnecessarytoanalyzewhetherthecurrentassetsoftheenterprisearegreaterthanthecurrentliabilities.Ifthecurrentassetsaregreaterthanthecurrentliabilities,itmeansthatthecompanyhasthesolvencyandcanguaranteetherightsandinterestsofcreditors.

Analysisofsettlementliabilities:Settlementliabilitiesmainlyincludenotespayable,accountspayable,andaccountsreceivedinadvance.Theanalysisofsettlementliabilitiesmainlydependsonthebusinessreputationoftheenterprise.Thiskindofbusinessreputationcomesfromfinancialinstitutionsandsuppliers,andismainlyreflectedintheamountofcorporatebillspayable,accountspayable,andaccountsreceivedinadvance.Alargenumberofbillspayable,accountspayableandaccountsreceivedinadvance,ontheonehand,showsthatfinancialinstitutionsgivecomprehensivecredittoenterprisesbasedonthecompany’scomprehensivereputationandbusinessscale,andontheotherhand,italsoshowsthatsuppliersprovidesupporttoenterprisesbasedonlong-termfriendlyexchangesandcooperativerelations.Andtrust,itshouldevenbesaidthatthesuppliergivesthecompanyapreferentialprice.Becausetheincreaseinsettlementliabilitiesmeanstheincreaseinthedebt-to-assetratio,andtheincreaseinthedebt-to-assetratio,thesolvencyofthecompanyhastobeconsidered,soastoavoidrestrictionsonthecompany'srefinancing.Inaddition,companiesshouldalsopayattentiontowhetherthesupplierhasacashdiscountonthepaymentmethod.Ifthereisacashdiscount,whethertheopportunitycostofthecashdiscountforthecompanyusingthecreditpurchasemethodislowerthantheloaninterest,thecompanymustweighandpasstheprosandconsAnalyzeandthendecidehowtobuy.

Analysisoffixedliabilities:Fixedliabilitiesareasourceofinterest-freefunds,whichmainlyincludetaxespayableandprofitspayable.Enterprisesshouldnotunderestimatetheuseofinterest-freefunds.Itcannotonlybringaboutdirectbenefitsthatcanbecalculated,butalsoindirectbenefitscausedbydirectbenefits,andsuchindirectbenefitscannotbecalculated.

Analysisoflong-termliabilities

Comparedwithcurrentliabilities,long-termliabilitieshavethecharacteristicsoflongmaturity,relativelyhighinterestrates,andpossiblylargeabsolutenumbers.Ifacompanycanuselong-termdebtcorrectlyandeffectively,itwillprovidemoreprofitopportunitiesforthecompany.However,ifthebusinessisnotoperatingwell,itmaycreatefinancingrisks,whichwillaggravatebusinessrisks,resultinginhighdebtandhighrisk,whichisalsoanimportantfactoraffectingthelevelofasset-liabilityratio.Therefore,theanalysisoflong-termliabilitiesismainlymeasuredfromtwoaspects:oneistousethecriticalpointofborrowingtomeasure.Thecriticalpointofborrowingisthepointatwhichtheinterestrateonborrowingisequaltothereturnontotalassets.Iftheinterestonborrowingislowerthanthereturnontotalassets,borrowingisfeasible,andviceversa.Second,makejudgmentsbasedonthemarketsituation.Ifthemarketprospectsaregoodandthereisabrightfuturefordevelopment,itwillbringhugeprofitstotheenterprise,anditisfeasibletoborrowmoney,otherwiseitisnotappropriatetoborrowmoney.

Calculationformula

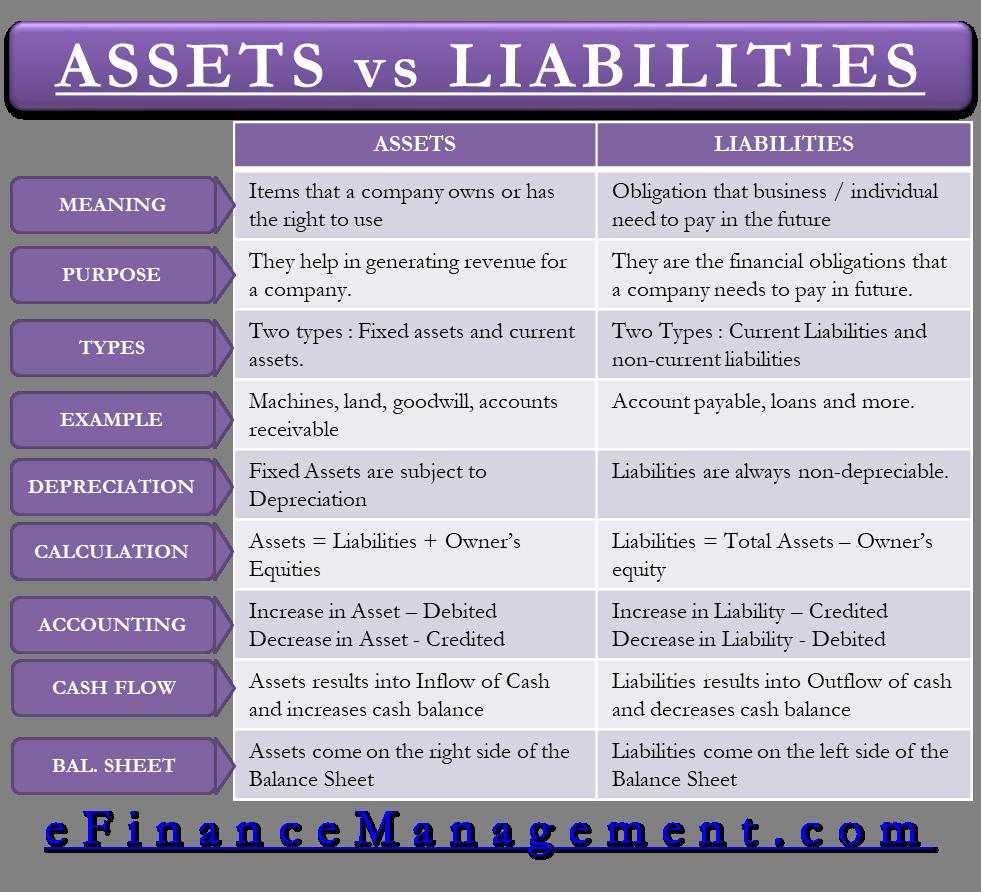

Asset-liabilityratio=totalliabilities/totalassets×100%

1.Totalliabilities:referstothesumofvariousliabilitiesundertakenbythecompany,Includingcurrentliabilitiesandlong-termliabilities.

2.Totalassets:referstothesumofvariousassetsownedbythecompany,includingcurrentassetsandlong-termassets.

Thedebt-to-assetratioisanimportantindicatortomeasurethelevelofcorporatedebtandthedegreeofrisk.Itcontainsthefollowingmeanings:

①Thedebt-to-assetratiocanrevealhowmuchofthecompany'stotalfundingsourcesareprovidedbycreditors.

②Fromtheperspectiveofcreditors,thelowertheasset-liabilityratio,thebetter.

③Forinvestorsorshareholders,ahigherdebtratiomaybringcertainbenefits.(Financialleverage,pre-taxdeductionsforinterest,gainingcontroloftheenterprisewithlesscapital(orequity)investment).

④Fromtheperspectiveofoperators,theyaremostconcernedaboutreducingfinancialrisksasmuchaspossiblewhilemakingfulluseofborrowedfundstobringbenefitstotheenterprise.

⑤Thedebtratioofanenterpriseshouldbeashighaspossiblewithoutadebtrepaymentcrisis.

Itcanbeseenthatincorporatemanagement,thelevelofasset-liabilityratioisnotstatic,itdependsontheanalysisfromwhichpointofview,creditors,investors(orshareholders),andoperatorsaredifferent;Itdependsonwhethertheinternationalanddomesticeconomicenvironmentisatitspeakorbottomingout;italsodependsonwhetherthemanagementisradicalormoderateorconservative.Therefore,therehasnotbeenaunifiedstandardformanyyears,butforcompanies:generally,assetsareconsidered.Theappropriatelevelofdebtratiois40%to60%.

Thisratioisaslowaspossibleforcreditors.Becausetheowners(shareholders)ofthecompanygenerallyonlybearlimitedliability,andoncethecompanygoesbankruptandliquidates,theincomefromtherealizationofassetsislikelytobelowerthanitsbookvalue.Soifthisindicatoristoohigh,creditorsmaysufferlosses.Whenthedebt-to-assetratioisgreaterthan100%,itindicatesthatthecompanyisalreadyinsolvent,whichisveryriskyforcreditors.

Thedebt-to-assetratioreflectstheproportionoffundsprovidedbycreditorsinallfunds,andthedegreeofprotectionoftherightsandinterestsofcreditorsbycorporateassets.Thelowertheratio(below50%),thestrongerthesolvencyofthecompany.

Usually,thesellingpriceofassetsatthebankruptcyauctionislessthan50%ofthebookvalue.Therefore,ifthedebt-to-assetratioishigherthan50%,theinterestsofcreditorswillnotbeprotected.Therearesignificantdifferencesintheliquidityofvarioustypesofassets.Therealizationofrealestatehasasmalllossofvalue,whilespecialequipmentisdifficulttorealize.Differentcompanieshavedifferentasset-liabilityratios,whicharerelatedtothetypesofassetstheyhold.

Infact,theanalysisofthisratiodependsonwhostands.Fromthepointofviewofcreditors,thelowerthedebtratio,thebetter,thecompanyhasaguaranteeofdebtrepayment,andtheloanwillnothavetoomuchrisk;fromthepointofviewofshareholders,whenthetotalcapitalprofitrateishigherthantheborrowinginterestrate,thelargerthedebtratio,thebetter,Becausetheprofittoshareholderswillincrease.Fromtheperspectiveoffinancialmanagement,whenmakingdecisionsaboutborrowingcapital,companiesshouldreviewthesituation,considerthesituationinanall-roundway,fullyestimatetheexpectedprofitsandincreasedrisks,weightheprosandcons,andmakecorrectanalysisanddecision-making.

Judgmentcriteria

Judgingwhetherthedebt-to-assetratioisreasonable

Tojudgewhetherthedebt-to-assetratioisreasonable,wemustfirstlookatyouWhosestand.Thedebt-to-assetratioreflectstheratioofdebtprovidedbycreditorstototalcapital,andisalsocalledthedebt-to-businessratio.

Lookatthepositionofthecreditors

Theyaremostconcernedaboutthesafetyofthemoneylenttothecompany,thatis,whethertheprincipalandinterestcanberecoveredontime.Ifthecapitalprovidedbyshareholdersonlyaccountsforasmallproportionofthetotalcapitaloftheenterprise,theriskoftheenterprisewillbemainlybornebythecreditors,whichisdetrimentaltothecreditors.Therefore,theyhopethatthelowerthedebtratio,thebetter,andthatthedebtrepaymentoftheenterpriseisguaranteed,andtheloantotheenterprisewillnotbetoorisky.

Fromtheperspectiveofshareholders

Sincethefundsraisedbycompaniesthroughdebtandthefundsprovidedbyshareholdersplaythesameroleinbusinessoperations,shareholdersareconcernedaboutItiswhethertherateofreturnontotalcapitalexceedstheinterestrateofborrowedmoney,thatis,thepriceofborrowedcapital.Whentherateofreturnonallcapitalreceivedbytheenterpriseexceedstherateofinterestpaidforborrowing,theprofitforshareholderswillincrease.Ifonthecontrary,theprofitratefromtheuseofallcapitalislowerthantheinterestrateonborrowing,itwillbedetrimentaltoshareholders,becausetheexcessinterestonborrowedcapitalmustbecompensatedbytheshareofprofitsearnedbyshareholders.Therefore,fromthestandpointofshareholders,whentherateofreturnontotalcapitalishigherthantheinterestrateonborrowings,thelargerthedebtratio,thebetter,otherwisetheoppositeistrue.

Enterpriseshareholdersoftenusedebtmanagementtoobtaincontrolofthecompanywithlimitedcapitalandpayalimitedprice,andcanobtaintheleveragebenefitsofdebtmanagement.Itiscalledfinancialleverageinfinancialanalysis.

Itdependsontheoperator’sposition

Ifthedebtistoolargeandthecreditor’spsychologicaltoleranceisexceeded,thecompanywillnotbeabletoborrowmoney.Ifthecompanydoesnotraisedebt,orthedebtratioissmall,itmeansthatthecompanyisshrinking,lacksconfidenceinthefuture,andhasapoorabilitytousecreditor’scapitalforbusinessactivities.Fromtheperspectiveoffinancialmanagement,companiesshouldreviewthecurrentsituationandconsiderthesituationinanall-roundway.Whenusingasset-liabilityratiostomakeborrowingcapitaldecisions,theymustfullyestimateexpectedprofitsandincreasedrisks,weightheprosandconsbetweenthetwo,andmakecorrectdecisions.

Otherrelated

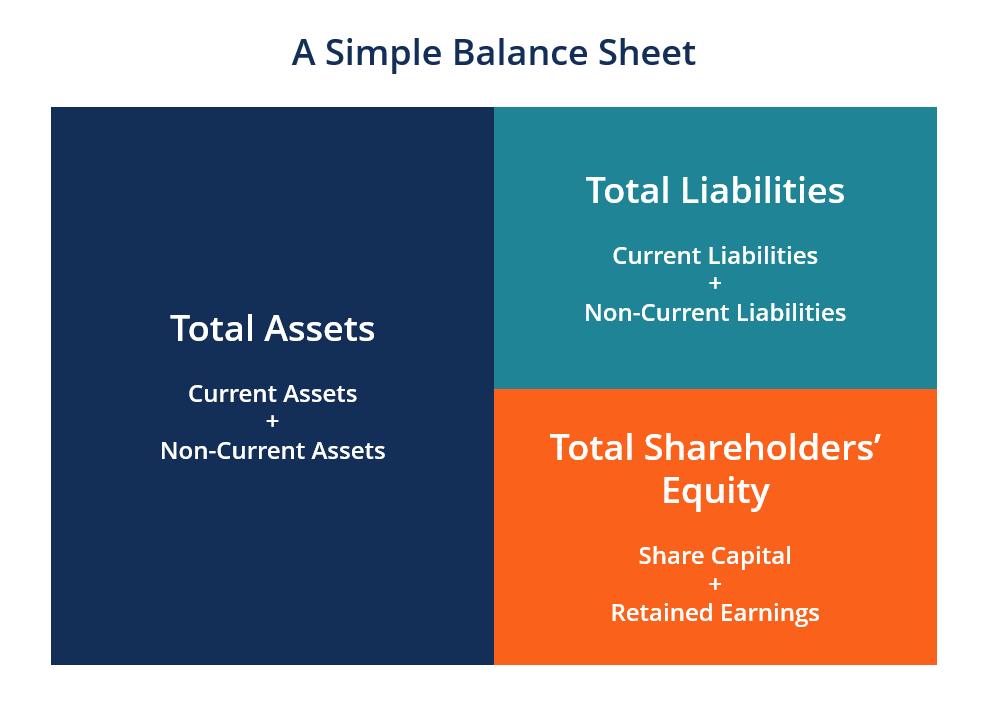

Thebalancesheetisoneofthethreemajorfinancialstatementsofacompany’sfinancialreport.Useappropriatemethodsandindicatorstoreadandanalyzethecompany’sbalancesheetforcorrectevaluation.Thefinancialstatusandsolvencyofanenterpriseareextremelyimportanttoarationalorpotentialinvestor.Beforereadingandanalyzingthebalancesheet,youshouldunderstandthefollowingaspects:

First,understandthenatureofthebalancesheetandunderstandwhatinformationthebalancesheetcanrevealtothepublic.Specifically,assetsandliabilitiesarestaticfinancialstatementsthatreflectthefinancialstatusoftheenterpriseonacertaindate(thatis,atacertainpointintime),inadditiontodirectlyreflectingtheeconomicresources(assets)thattheenterprisehasorpossessedonthepreparationdateofthestatement.Inadditiontothedebtsborneandtherightsandintereststhatshareholdersshouldenjoyintheenterprise,therelevantinformationinthestatementscanalsobeprocessedtoindirectlyreflectthesoundandreasonablefinancialstructureoftheenterpriseandthelevelofdebtsolvency.

Secondly,understandsomebackgroundinformationrelatedtothecompany,suchasthenatureofthecompany,businessscope,mainproducts,fiscalandtaxationsystemsandpoliciesandtheirchanges,andsomemajoreventsthatoccurredthroughouttheyear,etc.Wait.Inaddition,itisnecessarytounderstandthemacroeconomicpoliciesofsomecountries,suchaschangesinindustrialpolicies,finance,accountingsystems,andtaxation.

Third,understandandmastersomebasicanalysismethods.Inthebasicanalysisoffinancialstatements,themostcommonlyusedandmostconvenientandeffectivemethodsarenothingmorethanstructuralanalysis,trendanalysisandratioanalysis.Thedifficultyistobeabletoskillfullyandcomprehensivelyusethesemethodstoanalyzetheseeminglyisolatedandsingleinformationinsomecorporatefinancialstatements.ThemostdifficultthingtograspisthecriteriatochoosetoevaluatetheinformationthattheCPAoryouhavealreadyobtainedorprocessed.

Facedwithalotofdatainthebalancesheet,youmayfeelataloss,notknowingwhereyoushouldstart.Basedonmyexperienceandexperienceinactualwork,Ithinkwecanstartfromthefollowingaspects:

Firstofall,takealookatthemaincontentofthebalancesheet.Fromthis,youwillbeThereisapreliminaryunderstandingofthetotalamountofstockholders’equityandthecompositionofvariousitemswithinandtheincreaseordecrease.Sincethetotalassetsofacompanyreflectthescaleofthecompany’soperationstoacertainextent,anditsincreaseordecreasehasagreatrelationshipwiththechangesinthecompany’sliabilitiesandshareholders’equity,whentheincreaseinthecompany’sshareholders’equityishigherthantheincreaseintotalassets,Itshowsthatthefinancialstrengthoftheenterprisehasrelativelyimproved;onthecontrary,itshowsthatthemainreasonfortheexpansionoftheenterprisescaleisthelarge-scaleincreaseindebt,whichindicatesthatthefinancialstrengthoftheenterpriseisrelativelyreducedandthesecurityofdebtrepaymentisalsodeclining.

Furtheranalysisofsomeimportantitemsofthebalancesheet,especiallytheitemswithlargechangesinthebeginningandenddata,orlargeredletters,suchascurrentassets,currentliabilities,fixedassets,costorInterest-bearingliabilities(suchasshort-termbankloans,long-termbankloans,notespayable,etc.),accountsreceivable,monetaryfunds,andspecificitemsinshareholderequity.

Forexample,ifthecompany’saccountsreceivableaccountfortoomuchofthetotalassets,itmeansthatthecompany’sfundsareoccupiedmoreseriously,anditsgrowthrateistoofast,indicatingthatthecompanymaybeaffectedbytheproductmarket.Weakcompetitivenessortheimpactoftheeconomicenvironment,thequalityofcorporatesettlementworkhasbeenreduced.Inaddition,theagingofaccountsreceivableinthenotestothestatementshouldbeanalyzed.Thelongertheagingofaccountsreceivable,thelesslikelyitistoberecovered.Anotherexampleisthatthecompanyhasmoredebtsatthebeginningandendoftheyear,indicatingthatthecompany’sinterestburdenpershareisheavier,butifthecompanystillhasagoodlevelofprofitabilityinthissituation,itindicatesthatthecompany’sproductshavebetterprofitabilityandoperationalcapabilities.Stronger,managershaveastrongersenseofriskandgreatercourage.

Forexample,intheequityofcorporateshareholders,suchasthestatutorycapitalreservefundgreatlyexceedsthetotalsharecapitalofthecompany,thisindicatesthatthecompanywillhaveagooddividenddistributionpolicy.Butatthesametime,ifthecompanydoesnothavesufficientmonetaryfundsasaguarantee,itisexpectedthatthecompanywillchoosethedistributionplanofissuingallotmentsharesinsteadofthedistributionplanofissuingcashdividends.Inaddition,intheanalysisandevaluationofsomeprojects,thecharacteristicsoftheindustryshouldbecombined.Asfarastherealestatecompanyisconcerned,ifthecompanyhasmoreinventory,itmeansthatthecompanymayhavemorecommercialhousingbasesandprojectsunderdevelopment.Oncetheseprojectsarecompleted,itwillbringhigheconomicbenefitstothecompany.benefit.

Secondly,tocalculatesomebasicfinancialindicators,thedatasourcesforcalculatingfinancialindicatorsmainlyincludethefollowingaspects:directlyobtainedfromthebalancesheet,suchasthenetassetratio;directlyfromtheprofitandprofitdistributionObtainedinthetable,suchasthesalesprofitrate;alsoderivedfromthebalancesheetprofitandprofitdistributionstatement,suchastheturnoverrateofaccountsreceivable;partlyderivedfromthecompany'saccountbookrecords,suchasinterestpaymentability.Duetospacelimitations,Iwillmainlyintroducethecalculationandsignificanceofseveralmajorfinancialindicatorsinthefirstcase.

1.Theindicatorsthatreflectwhetherthecompany’sfinancialstructureisreasonableinclude:

(1)Netassetratio=totalshareholders’equity/totalassets

ThisindicatorismainlyusedToreflectthecompany’sfinancialstrengthandsecurityofdebtrepayment,itsreciprocalisthedebtratio.Thelevelofthenetassetsratioisdirectlyproportionaltothefinancialstrengthofthecompany,butiftheratioistoohigh,itindicatesthatthefinancialstructureofthecompanyisunreasonable.Thisindicatorshouldgenerallybearound50%,butforsomeverylargeenterprises,thereferencestandardforthisindicatorshouldbelowered.

(2)Netvalueoffixedassetsratio=Netvalueoffixedassets/Originalvalueoffixedassets

Thisindicatorreflectstheoldandnewdegreeandproductioncapacityofthecompany’sfixedassets.Generally,thisindicatorshouldexceed75%isgood.Thisindicatorisofgreatsignificancetotheevaluationoftheproductioncapacityofindustrialenterprises.

(3)Capitalizationratio=long-termdebt/(long-termdebt+shareholder’sequity)

Thisindicatorismainlyusedtoreflectthecompany’sTheproportionofworkingcapital,sothisindicatorshouldnotbetoohigh,generallyshouldbebelow20%.

2.Theindicatorsthatreflectthesafetyandsolvencyofthecompany’sdebtrepaymentareasfollows:

(1)Currentratio=currentassets/currentliabilities

Mainlyusedtoreflectthecompany'sabilitytorepaydebts.Generallyspeaking,thisindicatorshouldbemaintainedata2:1level.Anexcessivelyhighcurrentratioisakindofinformationthatreflectstheunreasonablefinancialstructureofacompany.Itmaybe:

①Themanagementofcertainlinksinthecompanyisrelativelyweak,whichleadstothecompany’sThereisarelativelyhighlevelinsuchaspectsas;

②Enterprisesmaybeunwillingtoexpandthescaleofdebtoperationsduetotheirconservativemanagementconsciousness;

③Joint-stockcompaniesareissuingshares,increasingcapitalandallotingsharesorThefundsraisedthroughlong-termloans,bonds,etc.havenotyetbeenfullyputintooperation;etc.Butonthewhole,theexcessivelyhighcurrentratiomainlyreflectsthatthecompany'sfundsarenotfullyutilized,whilethetoolowratioindicatesthatthesecurityofthecompany'sdebtrepaymentisweak.

(2)Quickratio=(currentassets-inventory-prepaidexpenses-prepaidexpenses)/currentliabilities

Becausethecompany’scurrentassetsincludeapartoftheliquidity(currentInordertofurtherreflecttheabilityofenterprisestorepayshort-termdebts,peopleusuallyusethisratiototesttheweakinventoryandprepaidorprepaidexpenses.Therefore,thisratioisalsocalledthe"acidtest".Undernormalcircumstances,theratioshouldbe1:1,butinactualwork,theevaluationcriteriaoftheratio(includingthecurrentratio)mustbedeterminedaccordingtothecharacteristicsoftheindustry,andcannotbegeneralized.

3.Theindicatorsthatreflecttheshareholders’equityinthecompany’snetassetsareasfollows:

Netassetspershare=totalshareholders’equity/totalequity

Theindicatorshowsthevalueofeachstockheldbytheshareholdersintheenterprise,thatis,thevalueofthenetassetsrepresented.Thisindicatorcanbeusedtojudgewhetherthestockmarketpriceisreasonableornot.Generallyspeaking,thehighertheindex,thehigherthevalueofeachstock,butthisshouldbedistinguishedfromthebusinessperformanceofthecompany,becausethehigherproportionofnetassetspersharemaybeduetothecompany’sCausedbyahigherpremium.

Fourth,onthebasisoftheabovework,acomprehensiveevaluationofthefinancialstructureandsolvencyoftheenterprisewillbecarriedout.Itisworthnotingthatbecausetheaboveindicatorsaresingleandone-sided,youneedtobeabletoanalyzeandevaluatewithacomprehensiveandconnectedperspective,becausethelevelofindicatorsthatreflectthecorporatefinancialstructureoftencontradictsthecorporatesolvency..Ifthecompany’snetassetratioisveryhigh,itindicatesthatthesecurityofitsdebtrepaymentperiodisbetter,butatthesametimeitreflectsthatitsfinancialstructureisunreasonable.Yourpurposeisdifferent,theevaluationofthisinformationwillbedifferent.Forexample,asalong-terminvestor,whatyoucareaboutiswhetherthefinancialstructureofthecompanyissoundandreasonable;onthecontrary,ifyouappearasacreditor,hewillbeveryconcernedThedebtservicecapacityofthecompany.

Finally,itshouldbenotedthat,becausethebalancesheetonlyreflectsthefinancialinformationofacertainaspectofthecompany,youmusthaveacomprehensiveunderstandingofthecompany,andyoumustalsocombineothercontentinthefinancialreportPerformanalysistodrawcorrectconclusions.

Relatedreports

AsoftheendofNovember2014,theasset-liabilityratioofcentralenterpriseswas63.3%,adecreaseof0.2percentagepointsyear-on-year.Theaverageasset-liabilityratiofellforthefirsttimesince2008.

Inthepast2014,centralSOEsactivelyrespondedtothesevereandcomplexsituation,especiallytheprominentcontradictioncausedbytheincreasingdownwardpressureontheeconomy,andachievedgoodoperatingresults:FromJanuarytoNovember,thecentralSOEsachievedatotalprofitof1.28trillionyuanYuan,anincreaseof5.2%year-on-year,theeconomicefficiencyhitanewhigh,thehighestgrowthrateinthreeyears.